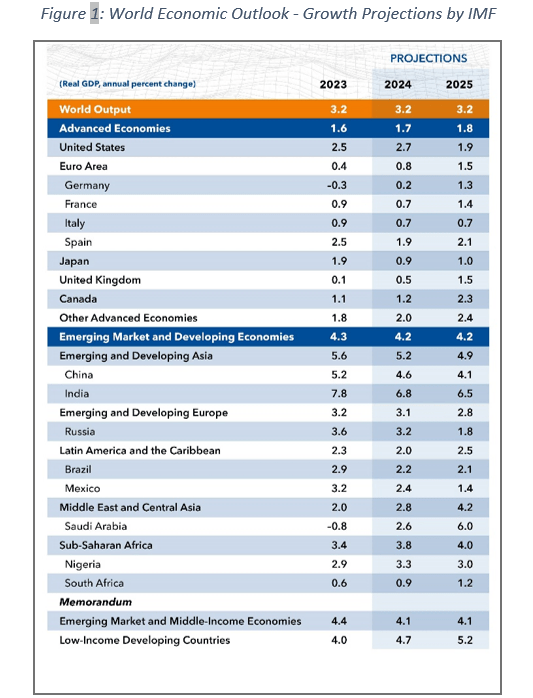

The International Monetary Fund (IMF) presents a steady and slow economic outlook for the future. The global economy is expected to grow at a pace of 3.2% in both 2024 and 2025, which is the same as the growth rate in 2023. However, there will be some variation between regions. In developed economies, growth will pick up slightly from 1.6% in 2023 to 1.8% in 2025, while in emerging markets, growth will slow down from 4.3% in 2023 to 4.2% in the following years

The IMF report shows that the global economy is quite resilient in the face of shocks. However, our research team suggests that the risk level in the global economy is increasing due to three main reasons:

Firstly, there are rising tensions between Western countries, especially the United States and the European Union, and China over trade and regional issues. These trade issues are related to China’s protectionist policies, which aim to export more and import less. There are signals that China may depreciate its exchange rate further to gain more trade advantage, which will further raise tensions.

Regional issues are related to Taiwan, the Philippines, and the South China Sea, which are strategically important for the United States. If regional conflict occurs, it will cause damage to global politics and the economy. The risk level of this scenario is moderate (7 out of 10), but the potential damage is high.

Secondly, there is a potential escalation of war between Israel and Hamas. Regional forces, especially Iran and the United States, could become involved, causing significant damage to global politics and the economy. This risk is moderate (3 out of 10) but has the potential to cause higher oil prices, which will raise inflation worldwide and curb future growth rates in all economies, advanced and emerging.

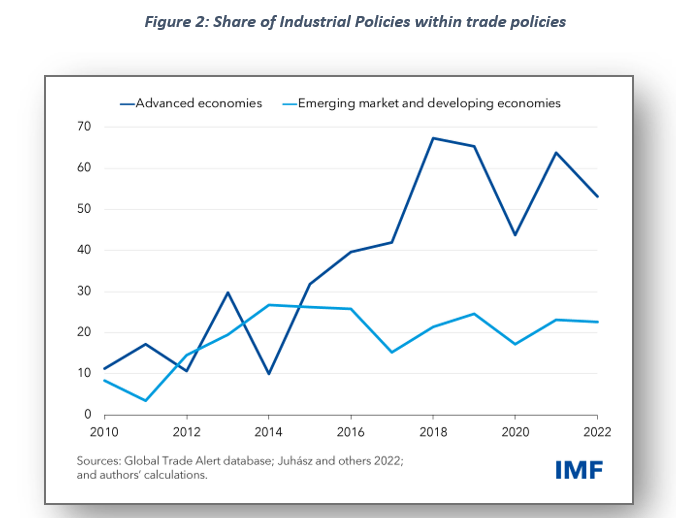

Thirdly, there is a high risk level (8 out of 10) of rising industrial policies, which are mainly protectionist in nature, and can severely damage globalization. This poses a higher level of risk for organizations working across borders or relying on international trade for their supply chain management.

Therefore, we suggest companies assess these risk factors and design strategies accordingly to raise their resilience. They need to understand how these factors can affect their business operations and develop contingency plans if these risks happen.

We have also developed models and techniques to help organisations manage these risky events.